Arizona Property Management & Investments

(888) 777 6664

Las Vegas Property Management & Investments

(855) 855 8182

BY: http://www.doctorhousingbubble.com

The Fed’s archaic language makes it very clear that there will be no

taper anytime soon. To the contrary, the Fed will still be buying

something like $75 billion a month in bonds instead of $85 billion.

What bold movement right? Of course this sent the stock market into

another easy money induced rally. However, during the same period we

find that existing home sales took a hit and prices are definitely softening. Over the summer, the popular FHA insured loans

took a giant hit via mortgage insurance premiums increasing

dramatically. This action certainly impacted the origination volume of

one product that was leveraging buyers into homes with as little as 3.5

percent down. Even in expensive SoCal, FHA insured loans made up 20

percent of purchases last month. In 2014 there will be new fees hitting

vanilla mortgages as part of the Federal Housing Finance Agency (FHFA)

trying to push private lenders to take on some of the mortgage market

which is fully dominated by the Fed and government. These fees will

happen at a time when home owners are already leveraging up to compete

with big money investors.

The slowdown in housing

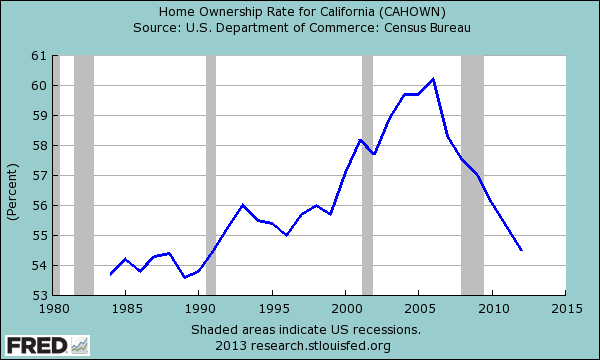

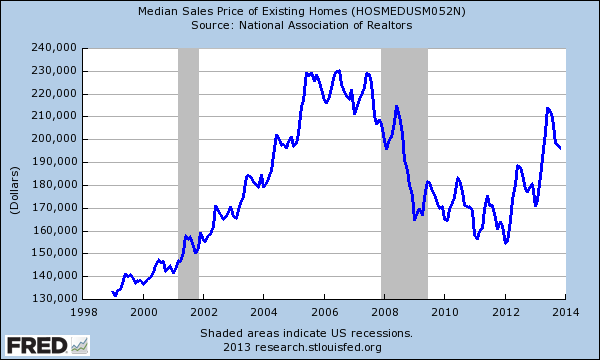

Higher rates have certainly had an impact on the housing market. The

median price nationwide has certainly slowed down during the last few

months (we will find out soon how much of this is seasonal and how much

of this is due to changing winds):

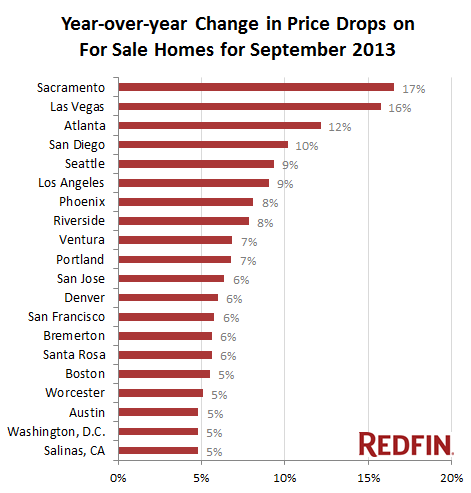

We’ve already noted that investors are certainly pulling back in many inflated markets around the country.

Some seem to think the Fed is fully omnipotent in controlling rates.

People do realize that the 30-year fixed rate mortgage has gone up over

100 basis points in spite of the Fed now having a balance sheet well

above $4 trillion and now owning 12 percent of the mortgage market?

When the stock market is rallying as it is, tiny gains in land-lording

don’t look as appealing as jumping on the next IPO.

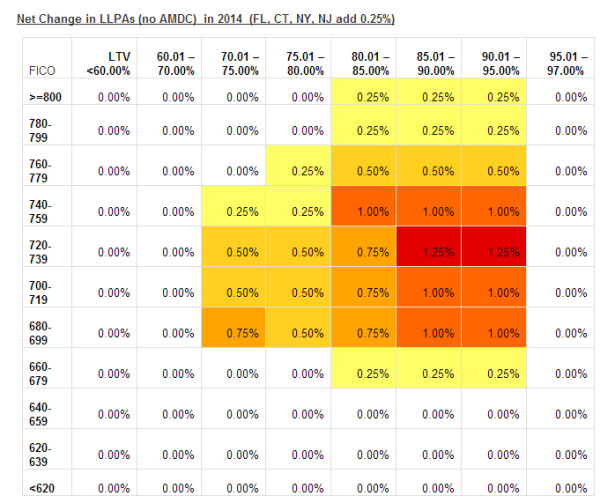

The new fee increases next year will have an impact. They come in two parts:-1. A mandated 0.1 percent to the rate for all new loansThe second item is going to make a bigger impact as it is going to make it more expensive for people to borrow (table below depending on LTV):

-2. Loan Level Price Adjustments (LLPAs)

Source: Mortgagenewsdaily

These are fairly significant increases when you consider most middle

class families are squeezing into mortgages. The bigger impact from

LLPAs will come with raising the standard with credit scores for the

best mortgage rates. For example, borrowers with scores of 740 receive

Fannie Mae’s lowest pricing but the new requirements will push it above

800. In 2007 a 680 received the best (and look how things turned out).

Again, I want to be clear that the last housing crisis was brought on

by more than just subprime buyers. The bulk of people that lost their

homes were in traditional vanilla 30-year mortgages. The facts back

this up. Yet people like to believe that subprime borrowers were the

central cause of the implosion of our entire system.

The FHA already required

a lifeline this year since loans were performing poorly in spite of the

hot market. The problem with looking at aggregate data is that the 30

percent cash buyers have distorted the typical down payment across the

board. For example, the typical down payment for FHA buyers is 4

percent (slightly above the mandated minimum 3.5 percent). Adjustable

rate mortgages are already going up in usage as more regular buyers need

more leverage as household incomes are not going up.

Folks in the mortgage industry realize this is going to be a big

impact and there is already buzz because of this. When mortgage

applications hit multi-year lows even before any of these changes hit:

Source: Bloomberg, ZeroHedge

Mortgage applications hit a 13 year low even with the housing market

having one of its best years in terms of prices. Let us be clear,

prices moved because of low inventory, low rates (for the first half), and manic demand from investors. Yet this has obviously changed towards the end of the year.

Regular buyers are already tapped out and the data reflects this.

There is also an odd notion that folks, either domestic or

international, are ready to lose their money no matter what in real

estate. People do realize that many people that have saved a good

amount are actually concerned about preserving their funds? This is why

investors have slowed down buying

in this market. As those double-digit price gains ebb to single-digit

to possibly flat or negative year-over-year gains, the headlines will

enter another echo chamber that isn’t going to sound so pleasing to

investors. It already started in the middle of the year.

The fee increases coming next year simply add another cost to getting

a mortgage regardless of what the 30-year does or doesn’t do (similar

to MIP on FHA insured loans).

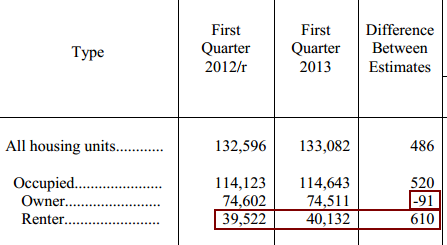

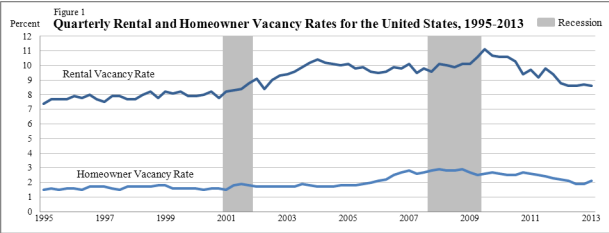

People also were pointing to the nice little jump in recent housing

starts but most of these were for multi-unit dwelling (i.e., the rental revolution continues).

Arizona Property Management & Investments

(888) 777 6664

Las Vegas Property Management & Investments

(855) 855 8182