Arizona Property Management & Investments

Call For a Free Property Management Quote:

(888) 777 6664

A+ rating with BBB/ Honor Roll List with ADRE

Payam Raouf

Designated Broker/Owner

Where are we going from here?

On the one hand I wish the phones stopped ringing, on the

other this is best market we have had since the crash of real estate in 2006/2007.

In some areas prices have surpassed the heights

of 2004/2005, in others they are getting very close to it.

Unemployment is at its lowest level in Phoenix Metro since

2006. Good luck finding a handyman, a skilled construction worker or even a skilled

office manager at a reasonable hourly rate! In June 2015 unemployment rate

dropped to 5% less than the 5.3% national average. There have been 61,400 new hires in Maricopa

and Pinal counties since February 2014, according to the Arizona Department of

Administration --- a pace higher than

the average number of new jobs created during February over the last 10 years.

Mortgage companies are back logged 45 to 60 days. Days you

put an offer with closed of escrow within 30 days are over! Rates are low, down

payment assistance programs are back, financial institutions have eased up, first

time home buyers and renters are swarming the market and multiple offers

jamming up the fax machines.

Title companies, I call them the “Moo Cow Corrals” offer no incentives

to Realtors to get their business, let alone offering their clients a glass of

water going to sign their docs. Buyers, Seller check your HUDs twice before you

sign on the dotted line. They are making a ton of mistakes.

Who is buying who is moving to Phoenix?

Renters who lost their homes are on the top of the chart, second

to that are the first time home buyers and thirdly savvy investor, Californians and opportunists.

From 2008-2011forclosures and short sales had become the

norms of the market. As the result, too many home owners lost their homes and

entered the rental market. 7 out of 10 of our tenants when they give their

notice to vacate, “BOUGHT A HOUSE” is their answer to why they are moving out.

With rent increasing 15 to 30 percent in most areas in the

past 18 months and how affordable homes

are still out here in Phoenix Metro, rates being so low, banks competing and sellers contributing up to 3% towards buyers closing costs, it will be foolish not to buy a home. We see a lot of first time home buyers entering the market. For just a little more than their deposits and first months rents combined, they are buying homes and their payments are equal or a bit higher than the rent.

are still out here in Phoenix Metro, rates being so low, banks competing and sellers contributing up to 3% towards buyers closing costs, it will be foolish not to buy a home. We see a lot of first time home buyers entering the market. For just a little more than their deposits and first months rents combined, they are buying homes and their payments are equal or a bit higher than the rent.

Savvy investors sold their investment properties in

California where prices have sky rocketed and it feels like we are back in the

2003 area where speculators were sleeping behind the new home construction

offices to enter into a drawing to buy a home. Owning rental properties in

Phoenix Metro pencils out way better than in larger metropolitan areas, especially

in California. I heard from one investor in California that the exchange boards

at her 1031 exchange office are filled up with investors looking to complete

their exchanges and no properties to exchange it with in California that makes any sense.

A lot of them are coming to Arizona from buying one to multiple single

family homes to mid and large size multiplexes. I know first hands because we

are getting those calls.

Younger Californians especially from Silicon Valley area are

moving to Scottsdale. They tell me, you cannot get a decent condo for $700,000

up there. A 3000 square feet home with pool on a large size lot in a decent

area costs a fortune. Most tech guys work from home anyway. So we get a lot of

those calls too. Quite a few that have already moved down here seem to be very happy with their decisions specially the ones with children.

We also see a lot of big corporations in the east coast transferring

their head honchos to Phoenix Metro looking to expand their operation. Cooperate

relocation has picked up by at least 6% in the last 12 months and a few more

applications are under review as we speak.

Recently there have had quite a few tenants with good

credits from Los Angeles and Orange County moving to Arizona in search of new opportunities.

Soon they will enter the home buying

market as well.

Who are the sellers?

A)

Owners that have been under water with their mortgages

for the last ten years finding it now make sense to sell.

B)

Canadians investors: Most of the Canadians who

bought investment properties in Phoenix Metro bought in when Canadian Dollar

and US Dollar were at par in 2011. Now one US Dollar equals to 1.33 Canadian

Dollar so they enjoy the property value appreciation plus an additional 33%.

C)

Owners who are up sizing/downsizing. Regular sellers.

D)

Flippers. There are still some opportunities not

as much in the lower end homes out there to fix and flip. Higher price homes

make more sense as long as the economy is doing well. A fine line to walk in

that area. Be careful.

E) Very little foreclosure.

We specialize in buying and selling investment opportunities

from a single family home to multi million dollar multiplexes. Our team at Global Real Estate Investments consists

of seasoned Realtors that have got the pulse of the market and can lead you to

the right opportunities. Our property management Company, Arizona Property Management & Investments is an award winning

property Management Company in Phoenix Metro ready to get your vacancies filled

and get those dollars into your back account reducing your liabilities. Our Maintenance Company, Arizona Handyman and Remolding Services LLC makes sure your investment is maintained well and up to date at a reasonable cost

reducing your overhead adding to your

bottom line.

Please call me directly at 888-777-6664 ext 114 ( please make sure you tell the receptionist

you are an investor, they screen all my calls) or email me at info@azezrentals.com.

By looking at the articles below, you will see that we have

been preaching those areas to our investors for the past two years. We know what, where and how to help you make your next investment move to

maximize your long and short term gains. Don’t make this decision on your own

even if you live in Phoenix yourself. This is a free consultation.

Thank you.

Payam H. Raouf

(888) 777 6664 ext 114

info@azezrentals.com

Thank you.

Payam H. Raouf

(888) 777 6664 ext 114

info@azezrentals.com

Arizona Property Management & Investments

Call For a Free Property Management Quote:

(888) 777 6664

A+ rating with BBB/ Honor Roll List with ADRE

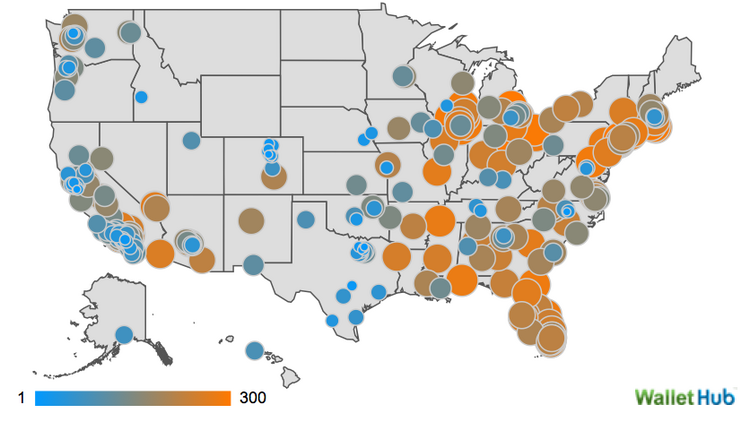

8 Phoenix-area cities hit top 50 healthiest US housing markets

Eight Arizona cities are rising in the ranks

of healthiest housing markets in the U.S., according to a WalletHub

study. They all landed in the top 50 healthiest U.S. housing markets for

comparably sized cities based on population.

Gilbert, a

midsize city, ranked the highest of the Arizona cities at No. 11.

Chandler was next at No. 22 and Tempe ranked No. 28 in the midsize

cities. Among large U.S. cities Mesa ranked No. 40 and Phoenix was No.

46.

The website

consolidated rankings in 14 criteria, including pricing, percent of

homes still under water, days on market, affordability, and other

measures to determine the healthiest markets in the U.S.

Texas topped the healthiest markets list with No. 1 positions for Austin (large), Plano (midsize) and Frisco (small).

Other Western

markets ranked high as well. Seattle (No. 2, large) and Denver (No. 3,

large) ranked higher than all Arizona cities. Salt Lake City (No. 21,

midsize), trailed Gilbert, but was just one ranking ahead of Chandler.

Rank of Arizona cities among healthiest U.S. residential real estate markets

- 11 Midsize - Gilbert

- 22 Midsize - Chandler

- 28 Midsize - Tempe

- 35 Midsize - Peoria

- 36 Midsize - Scottsdale

- 40 Large - Mesa

- 46 Large - Phoenix

- 49 Large - Tucson

- 55 Midsize - Glendale

- 88 Small - Surprise

- 123 Small - Yuma

Source: WalletHub

Eric covers economic development, banking and finance, infrastructure, transportation and utilities.