Payam Raouf

Designated Broker

Arizona Property Management & Investments

(888)7776664 ext 114

To Get a Free Home Valuation

Please click on the link below:

MyTrueHomeValue.com

___________________________________________________________________________________

The renting revolution: As home prices rise, the nation continues to add renters in lieu of home owners. Is this a temporary shift or something more permanent?

By: doctorhousingbubble.com

Renting is in vogue. Regardless of the rhetoric, we have added over 1

million renting households since the housing bubble burst in epic

fashion while losing home owners. What is interesting in spite of the rapid rise in home values

is that many more households are becoming renters. Part of this

dynamic is occurring because of a dramatic amount of purchases going to

investors seeking to become landlords but also, we have 5 million people

that have lost their homes to foreclosure and may now opt to go the

renting way. The nation is becoming much more comfortable with renting a

variety of items including cars (ZipCar), locations for brief trips

(AirBnB), and of course housing. It is also the case that a large part

of our nation is having a tough time financially and job security is

definitely not what it used to be so people are opting for more

mobility. It is a fascinating reversal that reflects a change in

economics and also a drive by investors leveraging low rates to chase yields in unlikely markets. Is this a temporary trend of something more permanent?

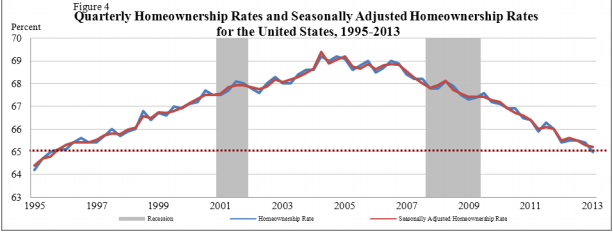

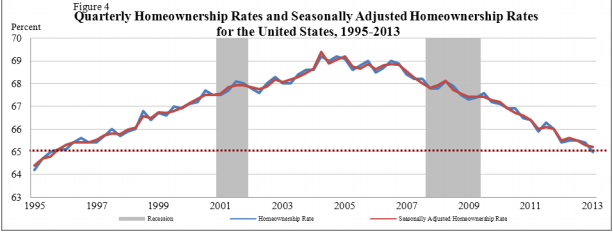

Nationwide homeownership rate

The homeownership trend is rather clear:

Source: Census

The peak was reached in 2004 and has now reliably fallen to levels

last seen in 1995. Interestingly enough, household incomes adjusting

for inflation are also back to levels last seen in 1995. As we

mentioned in a previous article, if we include all additional households

in negative equity positions the homeownership rate is likely closer to

62 percent pushing the chart to multi-decade lows. It is clear that

once the bubble burst in 2007 that the quick reversal was because of

people losing their leveraged properties.

But the housing market is on a rapid ascent up at least with prices and

in some markets with mania like actions taking place. So why is this

happening?

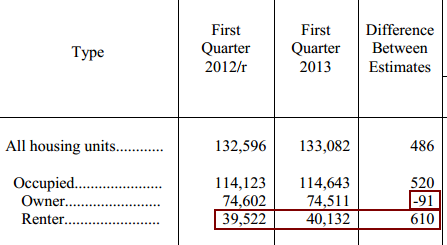

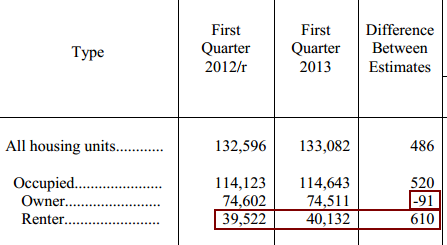

We’ve added over 1 million renting households since the bubble

popped. In the last year alone, we’ve lost on a net basis 91,000 owner

occupied households and added 610,000 renters. In this period, we’ve

also added 486,000 additional housing units. Doing the math and given

the investor demand, the additional housing units are very likely in favor of rental supply (multi-unit housing permits are also on the rise).

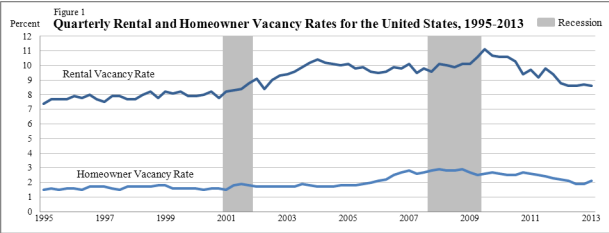

The push towards renting

The good news is the rental vacancy rate continues to decline:

At least from a renting perspective, this is a positive trend for

those owning rental properties. Obviously Wall Street spotted this

trend since the bubble burst and has been diving in hand over fist into

the housing market pool, initially empty but knowing the Fed would be

the source of the water. Yet

some markets in Arizona, Florida, and Nevada

are saturated with rentals. There is now a likely tipping point in

terms of large money investors putting in large sums of money for very

weak yields. After all, with rates zooming up and the stock market on a

roll there are other sectors to chase for money.

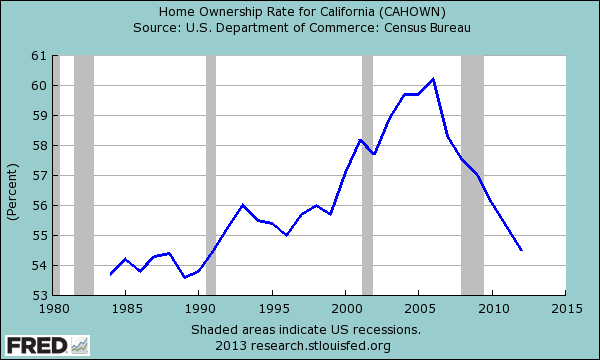

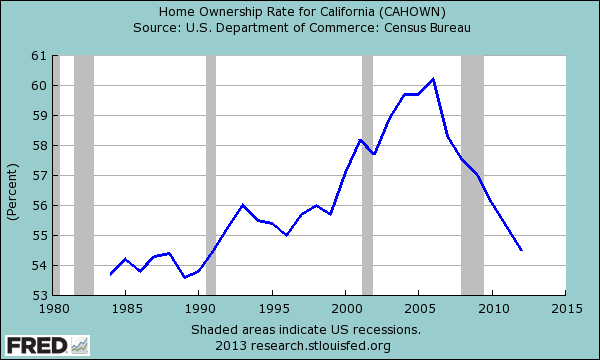

Expensive state nearly 50/50 when it comes to renters and home owners

California’s homeownership rate is inching closer to where it was in

the 1980s in spite of home prices going bonkers in the last year or so:

California has a homeownership rate of 54 percent and with negative

equity owners thrown in we are closer to 50 percent meaning half the

state is renting. And make no mistake, those that are underwater are

basically in a renting position or worse. They cannot move without

selling their home for a loss. At least with a rental, you give a 30

day notice and you can move as you see fit. Some that bought at the

peak, even with the wild appreciation in some areas, are still down

$100,000 or $200,000. To leave, they would have to pay to sell.

There is this pervasive logic that somehow, some people missed

another opportunity. These people claim that they want to buy to stay

put so what does it matter that the mania pushed prices up again? You

don’t unlock any equity until you sell! So in other words, they are

speculating since they say “I missed out on a $100,000 gain” but this

flies in the face of staying put and setting roots with your family. If

a simple one year move is enough to price these people out they are not

in a financial position to buy anyway. Yet some will never feel

satisfied until they own a home like they lost their trusted childhood

security blanket. Given the above data, this seems to be more of a

minority in probably high cost areas

because in most of the country you can buy a modest home with the

absurdly low interest rates and likely be at rental parity. In very

prime California markets, that is unlikely unless you come in with large

down payments (i.e., $200,000+) and are ready to contend with the

hoards of people stampeding into weekend open houses.

Looking at the data, the trend is very clear. As we have chronicled for a couple of years now the investor demand is unprecedented

and many are left diving in to fight for the limited supply or rent.

Because of the sour taste of the bursting housing bubble and emerging

trends regarding home buying behavior, renting has been on a solid trend

going back to 2007. Even with the recent gains in the market renting

is powering forward over buying. People adapt. Many people are finding

alternatives and are finding it more beneficial to live where they

choose based on their career and lifestyle mobility versus “drive until you qualify”

which is a very typical mindset in California. You also have to wonder

what impact this will have where in states like California, half rent

(think of raising taxes or other challenges that may arise in the future

when they go to vote).

I’m curious to hear in the comments about those that have decided to

rent versus buy in the current market even though they are financially

in a position to buy.

To Get a Free Home Valuation

Please click on the link below: