Arizona Property Management & Investments

(888) 777 6664

CLICK HERE TO A GET A FREE PROPERTY MANAGEMENT QUOTE

Handyman Daily

(855) 855-2345

Click Here to Get A Free Maintenance and

Handyman Daily

(855) 855-2345

Click Here to Get A Free Maintenance and

By: Dr Housing Bubble

There was an odd sort of rejoicing last week in the midst of market

volatility. Housing starts jumped but the people pointing at this

failed to grasp that a large reason for this was because of multi-family

housing starts. In other words, the demand is reflecting a nation that is becoming a renter class.

This trend reflects a new workforce that has more part-time employment

and less job security than the previous generation. Why would you buy a

home if your employment is more volatile? The numbers are clear and we

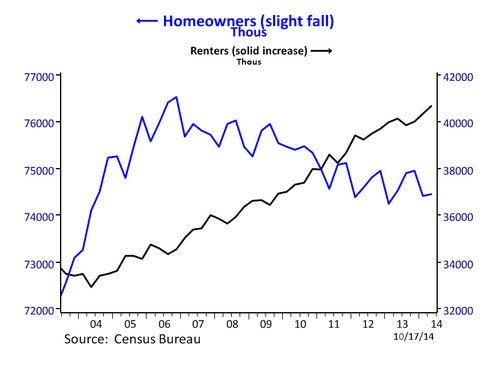

have added over 7 million renter households in the last 10 years.

Right now we are at the peak of renting households. However, we peaked

for homeownership back in 2006. Since 2006, we’ve actually lost about 2

million net homeowner households. No need to worry since Wall Street has taken up the slack to purchase those single family

homes and convert them back into rentals for the new modern day serfs.

The renting trend continues and the jump in housing starts reflects a

change in home buying perception.

Deconstructing housing starts

It probably is worth digging

into the housing starts data since some people were going hog-wild on

data that reflects a trend towards renting. Once broken down the solid

rise in housing starts was brought on by multi-family units. In other

words, high density lower cost housing options. You would like to see a

higher demand for single family homes if the case were to be made that

households were gearing up to purchase homes. Yet this isn’t something

builders are betting on.

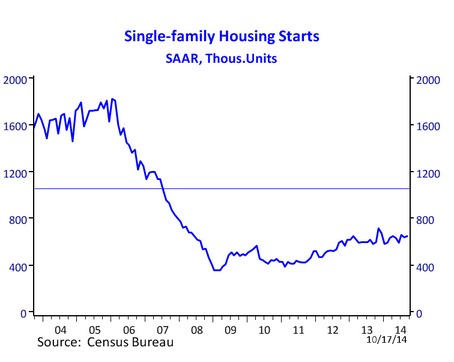

First take a look at single family housing starts:

Can you spot the so-called surge? Probably not. Since 2008 home

builders have been holding steady when it comes to single family homes.

After all, investors were out in the market looking for lower priced

properties to churn out healthier rental yields. In places like

California, many investors have already pulled back and we are seeing

the vacuum that is being left.

Many sellers are pulling their properties off the market thinking next

spring and summer they’ll be able to lure in some new lemming.

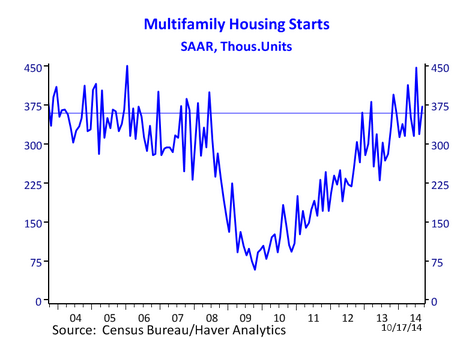

If we look into multi-family housing starts, we find an unmistakable trend:

That is what a surge looks like. This is a fury of activity to meet the demand of a renter nation.

No need to spin the above chart since it speaks loudly as to what

builders are viewing as the next big thing. Rents are holding steady

and younger Americans are carrying large amounts of student debt and

their salaries are unfortunately not all that great. That is why you

have 2.3 million adults living at home with their parents in California

alone.

We have added a whopping 7 million renter households in the last decade:

The number of households that rent has increased by 20 percent over

the last decade. This is a strong trend. This of course is coming at

the expense of creating less homeowners. This isn’t necessarily a good

or bad thing. In fact, I think the crap shack addicted

zip code chasers would in many cases be better off renting in the

long-term. Many use the logic of “well over 30 years if you stay…” but

rarely do they stay put for that long. Will you live in a 700 square

foot shack for 10 years just to build some equity so you can then move

into a 900 square foot shack in the endless property ladder game? This

of course assumes your timing is on given real estate is now a boom and

bust business. This is why in places like San Francisco, you have many

high tech workers opting to rent and foregoing the chase to buy

ridiculously priced properties.

It should be extremely clear that we are in a solid rental trend.

You can look at the housing start data above and arrive at your own

conclusion as to where this “surge” is coming from.

Arizona Property Management & Investments

(888) 777 6664

CLICK HERE TO A GET A FREE PROPERTY MANAGEMENT QUOTE

Handyman Daily

(855) 855-2345

Click Here to Get A Free Maintenance and

Handyman Daily

(855) 855-2345

Click Here to Get A Free Maintenance and