Arizona Property Management & Investments

(888) 777 6664

CLICK HERE TO A GET A FREE PROPERTY MANAGEMENT QUOTE

Investor exhaustion with investment properties hits: Blackstone’s acquisition pace has fallen by 70 percent from peak last year. Running the numbers on rentals in high priced markets.

By: Dr housing Bubble

Existing home sales had another weak month and the blame continues to be on the notorious polar vortex. On the other hand, California is in a record drought and we are in an endless summer yet sales have hit multi-year lows as well.

Could it be that over paying for a pre-World War II house is not

exactly fitting in the budget of the regular local buyer? It is one

thing to speculate but another to see what is happening on the ground.

The granddaddy of rental investors, Blackstone has tapered off its

investment buying binge dropping in acquisition volume by 70 percent

from their record highs from last year. These are folks that run the

numbers in bulk. I speak to many local investors and many have not

purchased properties in SoCal since early 2013 since the numbers simply

did not make sense then and they certainly do not make sense now for

cash flow opportunities. The rest of investors are the late comers and

the speculators, otherwise known as flippers.

It is interesting to see the mindset shift once again similar to 2006

when the volume was turned up so high that even uttering the words

“correction” labeled one as a “doomer” or some other attack not based on

numbers. Unless you see real estate going up forever, you are

basically camping out in a nuclear war shelter counting your stockpile

until the end of days. Yet numbers matter. In many states and in

certain markets, prices do make sense and have room to grow. Not so

much in California at least in the short-term. This is why as we

mentioned a site dedicated to housing data Zillow

has reached 70,000,000 unique readers a month. Apparently “setting it

and forgetting it” does not apply to housing. Let us run the numbers

assuming you were looking for cash flow properties in Arizona and

California.

Looking at investment properties in Arizona and California

In SoCal $500,000 gets you very little especially in L.A. and Orange

Counties. It might get you a nice condo in a sought after market. As

an investor, you are looking at cash flow on a variety of fronts. Tax

benefits are overplayed in many cases and most long-time investors

understand this. In fact, most seasoned investors will tell you to

allocate close to 50 percent of your gross rents to costs outside of the

regular mortgage payment. Many investors that I know are not your

Blackstone’s. They are folks that buy properties with at least 25

percent down and finance the rest through conventional banks or through

other lenders. They do put a large amount of skin in the game so the

numbers absolutely matter.

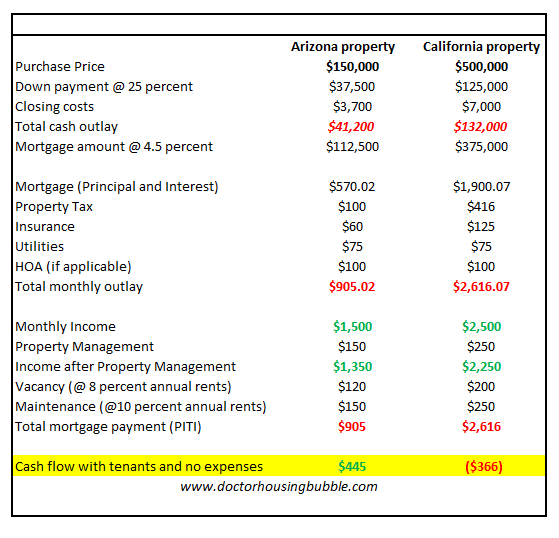

So let us take an example of two markets right now with Arizona and

California. It is very doable to find a $150,000 property in Arizona

that will rent for $1,500 and a $500,000 condo in California will get

you close to $2,500. This is very common. For some $500,000 in SoCal

seems like a great deal so we’ll run with that. I think people assume

that this unlimited investor buying spree is going to continue deep into the future. We are already seeing near record low sales volume even though prices went crazy in 2013.

So let us put together some figures here:

Sure, some will tell you to close your eyes and simply pick a place

and buy since real estate always goes up in certain markets. But for

investors, numbers absolutely matter and if Blackstone was optimistic on

the future they would be buying up these high priced properties but

they are not. I think the above numbers highlight why investors are

balking big time. Novice investors will throw out figures like “that

$2,500 a month in rent on that $500,000 home is great!” $30,000 in

gross rents seems great when you don’t crunch the numbers. They fail to

mention that you will fork out $132,000 of cold hard cash and still

have a $375,000 mortgage as well. I was very optimistic on the low HOAs

above because in some areas in Orange County HOAs of $300 and higher

per month are routinely common especially with condos.

You’ll notice that even in Arizona that $150,000 investment property

with 25 percent down is going to bring in something like $445 per month

assuming no vacancies, maintenance, or other unforeseen costs after your

outlays are factored in. Your tax benefits will absolutely depend on

your tax bracket but if you are shelling out this kind of money, you are

probably already at a very high tax bracket so any rental income you

get is going to get taxed nicely. Something tells me Blackstone is not a

poor organization.

But look at the figures for California. You are running in the red

with a 25 percent down payment here. This also assumes you are fully

rented, no monthly expenses, and you don’t need to do any major

repairs. People are waiving contingencies on these crap shacks and fail

to realize that a roof or slab work will likely eat up a few years of

profits. Plumbing work? Flooring? Labor is not cheap in SoCal.

What about appreciation? This is where speculation dives in and this

is why a correction is very likely to occur. You pay rents from net

monthly income! Investors are 30 percent of the market in SoCal. If

they are seeing these crude numbers is it any shock that they are slowly

pulling back? So when the year-over-year gains go stale and even

negative (which is very likely) do you think they will ramp back up?

The current pace makes no sense for investors already. The only reason

to purchase would be to flip and this is practically the definition of a

mania if we are not seeing underlying incomes increase. It is also why

California is largely becoming a part of the new renter nation.

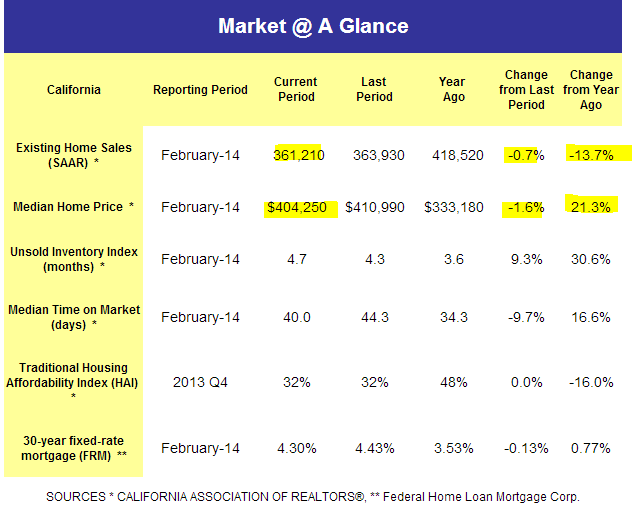

As an investor seeking out rental cash flow you can see why investing

in California overall is a poor proposition. The momentum we see today

comes from the 21 percent jump in the median home price in 2013:

It is interesting to hear those that talk about gains not actually

putting their money where their mouth is. If you assume that prices

will go up, go for it and buy that house in Culver City or Pasadena.

Why not? This is a sure bet from their perspective. Make it a rental

and reap those unlimited rewards. As I mentioned from talking with

investors that are deploying their own hard cash, California is not even

on their radar. The flippers

on the other hand are still out there. Whether you rent or buy, you

should understand the nature of running the numbers especially on the

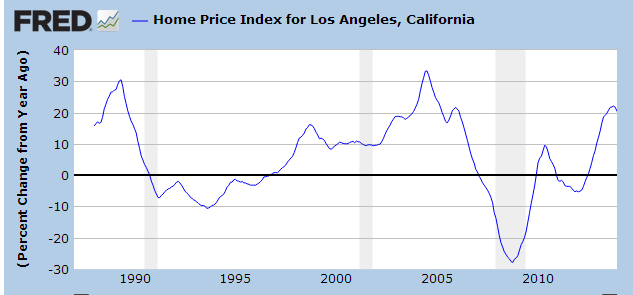

biggest purchase of your life. California for a generation has been

nothing but boom and bust. So it is interesting to hear these same

people talk about a permanent plateau as if this was the history of

SoCal:

The facts show boom and bust. Just the reality of our market. I’m sure the 7,000,000 folks that lived through a foreclosure wished they ran the numbers.

Arizona Property Management & Investments

(888) 777 6664

No comments:

Post a Comment