Arizona Property Management & Investments

(888) 777 6664

CLICK HERE TO A GET A FREE PROPERTY MANAGEMENT QUOTE

Handyman Daily

(855) 855-2345

Need Affordable Rental Property Handyman In Arizona?

Free Quote

Handyman Daily

(855) 855-2345

Need Affordable Rental Property Handyman In Arizona?

Free Quote

Feudal America creating an army of renters: A larger percentage of household income is going to rents and the CPI is once again missing the housing boom.

Dr Housing Bubble

The housing market without a doubt is slowing down and it should be

clear that the “hot” summer selling season is simply not going to

materialize. Even in house horny Southern California,

sales are down 12 percent year-over-year and the median price actually

fell in July from June. Typically, the sunny California sun fries the

portion of the brain looking at math during the summer but something

else is going on. People also conveniently forget that 7,000,000

foreclosures have occurred since the housing bust hit with 1,000,000

happening here in the “never a bad time to buy” California market. We

recently discussed the incredibly hot rental market in the state.

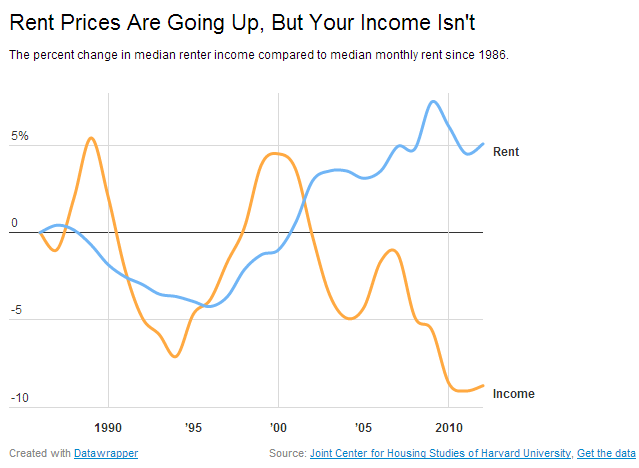

It seems that rents are having a good run over the last year as more

Americans welcome their new feudal landlords from Wall Street. In fact,

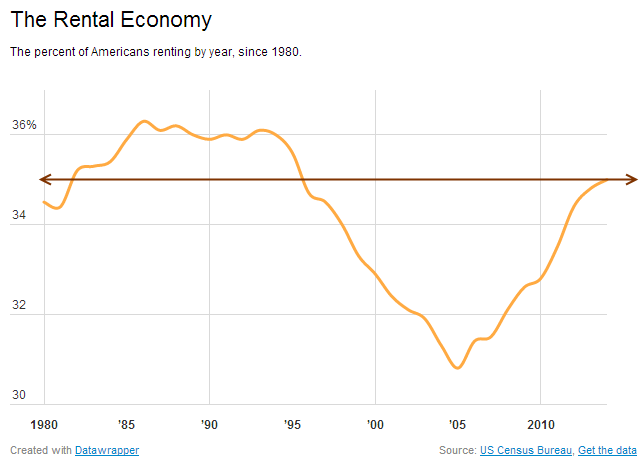

we now have the highest percentage of households renting in 20 years. If

we look at the data, what we find is that housing is simply consuming a

larger portion of income for households. It is amazing how many people

in California have absolutely no comprehensive plan for retirement. They

are willing to leverage every penny into housing but ignore other

important areas like building a balanced portfolio. Taco Tuesday baby

boomers sit in million dollar crap shacks welcoming their student debt laden children back home while they feast on Purina Dog Chow. It is pretty clear what is going on right now: more of your income is being consumed by housing.

The conveyor belt to rental nation is moving efficiently

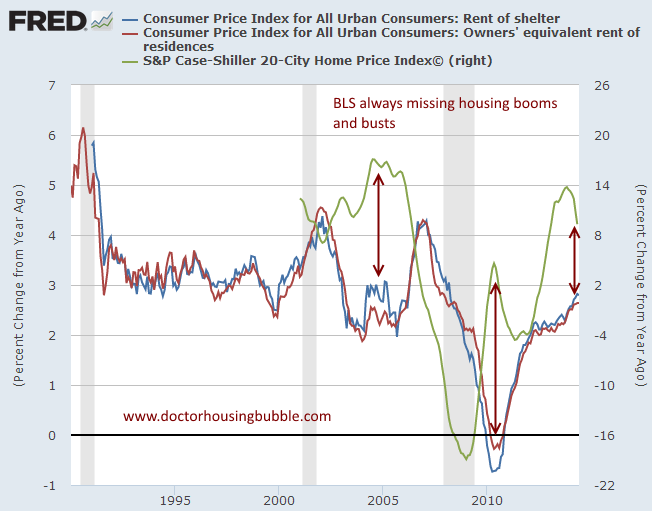

One of the points made during the early days of the first housing

bubble was that the Bureau of Labor and Statistics did a poor job

measuring housing inflation. The CPI uses the owners’ equivalent of rent

(OER) as a substitute to actual housing payments or underlying home

value (i.e., PITI). This does an okay job in stable housing markets but

fails in meth addicted housing cycles like the one we now live in. The

OER assumes you will rent your house out which of course, is not the

case unless you are Wall Street. Many of the $700,000 crap shacks in

SoCal would rent from $2,500 to $3,000 and probably went up about 5

percent over the last year. Yet some of these homes went up in price by

20 to 30 percent. If your goal is to measure price increases, shouldn’t

you actually measure the price of the actual thing versus some

derivative of it?

Since this is the measurement tool, you can see the big divergence in prices and rents here:

The CPI once again has missed the housing jump of 2013. For example,

in 2005 when the Case Shiller was showing 16 percent annual price

increases, the CPI was showing rents and the OER going up by 2.5 to 3

percent. Seems like a big difference but of course, this gives the Fed

more fodder to say inflation is muted even though housing is the biggest

line item for most American families.

You’ll notice that the Case Shiller Index which is one of our better

gauges of price went up nationwide by 14 percent last year. The CPI went

up by 2.6 percent for the OER. Big difference.

So how are people paying for all of this? Well people are simply paying more of their income to rent:

Source: Mother Jones

With rents, you have to pay with actual household income. This is why in California, you have 2.3 million adults living at home

because they simply cannot afford a rental. Pent up demand? I doubt it.

This is why sales are dropping and prices have gone stagnant. It isn’t

for want of buying. No. In fact people are lusting for housing just like

they were in 2005. If given the chance, people would “ice challenge”

their way into a ludicrous mortgage with the aspiration of property

laddering their way up into the feudal class. You might be a renting

pleb today, but tomorrow you will be the next oligarch of housing. By

the way, cash sales hit a four year low in SoCal since investors either

want massive annual gains or good cap rates.

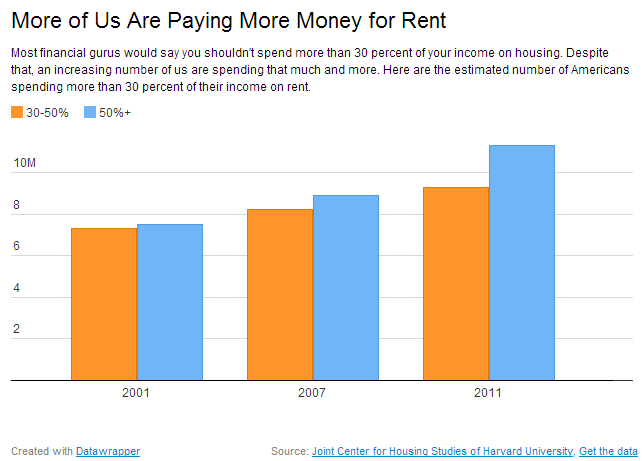

We now find that since the recession ended a massive number of

households are paying more than 50 percent of their income in rent:

In places like San Francisco,

I’m sure this is a good portion of households. This has big

implications for our spending addicted economy given that a larger

portion of households now rent:

Going back to the point of balancing out your plans for retirement,

so many people assume their residence is somehow going to throw off

income for them in old age. Many baby boomers are seeing this is not the

case. You have taxes, insurance, maintenance, and other costs that

actually suck money out of your income even when the principal and

interest are taken care of. The funny thing about this is the big push

for Prop 13 highlighted this at the core. That grandma that was being

“kicked out” on the street because of higher taxes was an example of

someone without a balanced portfolio. She had burned her mortgage but

like death, taxes will never go away. Current baby boomers drinking

Martinis in their hardwood floor and gold plated sarcophagus in SoCal

many times are scraping by even though they have solid equity in their

home. I love seeing a home in this category being put to market because

you can see how outdated the place has become. Living in million dollar

homes yet unable to make a few modifications.

Also, I tend to believe the renter numbers are understated. How many

“kids” living at home are even paying rents to their parents? All we

know is that 2.3 million adults in California live with their parents.

This is one state of many. So for older folks, what will their income

stream be in retirement? Social Security? Stocks? The figures don’t look

good here. In many cases you have people with one or two years of

living expenses and all of their net worth tied up in their home that

will cost money to maintain. Now you can see why Prop 13 struck a chord

back in the 1970s showing that history repeats and people in California

have been lusting for homes for many decades, a tradition of sorts.

Reverse mortgages are an option but your kids might hate you for it.

Screw them right? They can pile into a rental and play furniture Tetris

of getting in four people into a 2 bedroom 1,000 square foot place in

any hipster area of Los Angeles.

It should be clear that what is simply happening is more disposable

income is being taken into housing either by rents or mortgage payments.

In California, close to half the state rents (and a growing number are

living at home – rent or no rent). In L.A. County, the majority rent.

Keep in mind all of this is happening as the stock market caps a near

200 percent run from 2009 and housing is coming off a banner 2013 year.

Yet for Americans households, income growth is not keeping up. A big

deal for the growing number of renters. For now, get used to the trend

of feudal landlords.

Arizona Property Management & Investments

(888) 777 6664

CLICK HERE TO A GET A FREE PROPERTY MANAGEMENT QUOTE

Handyman Daily

(855) 855-2345

Need An Affordable Rental Property Handyman In Arizona?

Free Quote

Handyman Daily

(855) 855-2345

Need An Affordable Rental Property Handyman In Arizona?

Free Quote

No comments:

Post a Comment